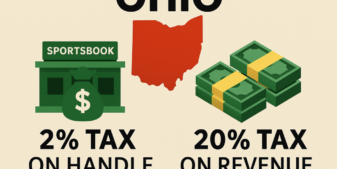

A bill introduced last week in Ohio proposes making the state the first in the US to place a tax on the betting handle in addition to gaming revenue.

Sen. Louis Blessing introduced SB199, which would put a 2% tax on the total wagered by bettors in Ohio, in addition to the current 20% tax on adjusted gaming revenue for online sportsbooks.

If enacted, Ohio would be the first U.S. state to implement both taxes simultaneously. Tennessee currently places a 1.85% tax on betting handle, but that is instead of taking revenue. The proposal comes after the state failed to approve a tax hike from 20% to 40%, put forward by Gov. Mike DeWine.

The majority of the additional revenue generated is earmarked for the maintenance and construction of publicly-owned sports facilities across the state.

Betting handle tax would double state income

At the current rate of 20%, the state has collected approximately $359 million since legalizing Ohio sports betting in 2023. In this time, Ohioans have wagered around $19 billion, so an additional 2% tax on the betting handle would have brought in an extra $380 million.

A substantial figure that looks set to rise as residents continue to bet more and more. In 2024, betting handle increased 15%, up to $8.9 billion from $7.7 billion in 2023.

In January this year alone, Ohio bettors wagered over $1 billion, almost matching the record of $1.13 staked in January 2023 following legalization.

However, is is estimated that unregulated platforms take in even more bets. A report published last month suggested unlicensed operators generated $1.5 billion last year, compared to licensed sportsbooks at $899 million.

Ohio considers legalizing online casinos

Lawmakers have been exploring various options to generate more revenue from gambling. In addition to Gov. DeWine’s proposed tax hike, there has also been discussions about legalizing online casinos in the Buckeye State.

Ohio Sports Betting Handle To Be Taxed By New Bill proposing to legalize online casinos, and it has gained bipartisan support. The bill proposes a 36-40% tax rate that could bring in an estimated $400 million in tax revenue. SB199 has been referred to the Select Committee on Gaming for discussion.As with sports betting, it is estimated Ohio online casinos operating in a legal gray area generate a substantial amount of revenue in the state, at $3.7 billion last year.

In total across regulated and unregulated markets operators generated approximately $7 billion from Ohio residents, almost as much as in New York at $7.3 billion. Yet, at a tax rate of over 50% on gambling, the Big Apple took in over $1 billion in tax revenue from gambling.

This bill is the latest attempt of Ohio lawmakers to cash in on the popularity of gambling in the state. The bill has until the end of the year to get through the various committees to come into law.